5 Trends Shaping Microloan Lending in 2025

As financial inclusion continues to expand across emerging markets, microloan lending is undergoing a rapid transformation. In 2025, industry experts are seeing significant changes in the way small-scale credit is being delivered, monitored, and repaid. From AI-driven loan assessments to the rise of community-based digital lenders, these trends are reshaping how underserved individuals and businesses access capital.

One major shift is the use of artificial intelligence (AI) and machine learning to evaluate borrowers. Rather than relying solely on traditional credit scores, fintech firms are leveraging AI to assess alternative data, such as mobile money activity, utility bills, and even social behavior. This method allows lenders to serve clients who were previously deemed "unbankable" by conventional institutions.

Another emerging trend is the decentralization of lending platforms. With the rise of blockchain technology, peer-to-peer lending systems are becoming more transparent and secure. These systems reduce reliance on intermediaries, thereby lowering the cost of borrowing and increasing profit margins for both lenders and borrowers. Some startups have already introduced smart contracts that automate the entire loan lifecycle.

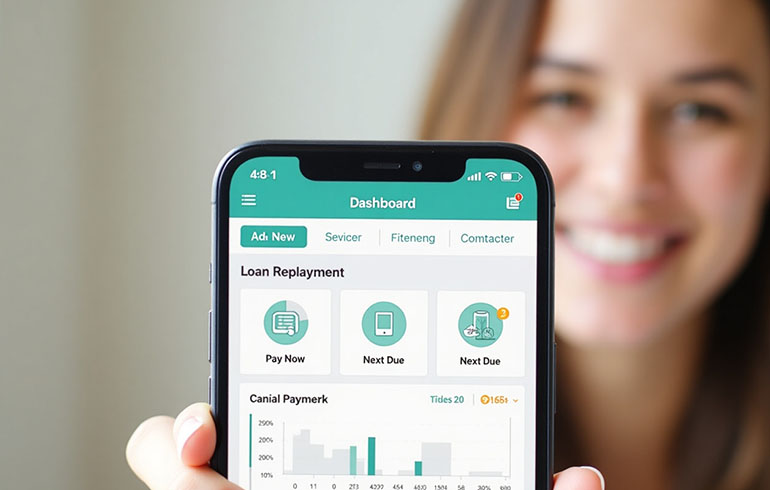

Mobile-first lending platforms are also becoming the norm. In many Europe and Asian countries, mobile phones serve as the primary banking tool. Fintech companies are capitalizing on this by offering microloans directly through mobile apps, enabling users to apply, get approved, and repay loans without stepping into a bank. This convenience is drastically increasing user adoption and repayment compliance.

Lastly, governments and international organizations are recognizing the role of microloans in poverty alleviation and small business development. In response, many are rolling out subsidies, digital training, and regulatory frameworks to support and protect borrowers. As these five trends take hold, microloan lending in 2025 is poised to become more inclusive, efficient, and impactful than ever before.