New Digital Tools Make Loan Repayment Easier Than Ever

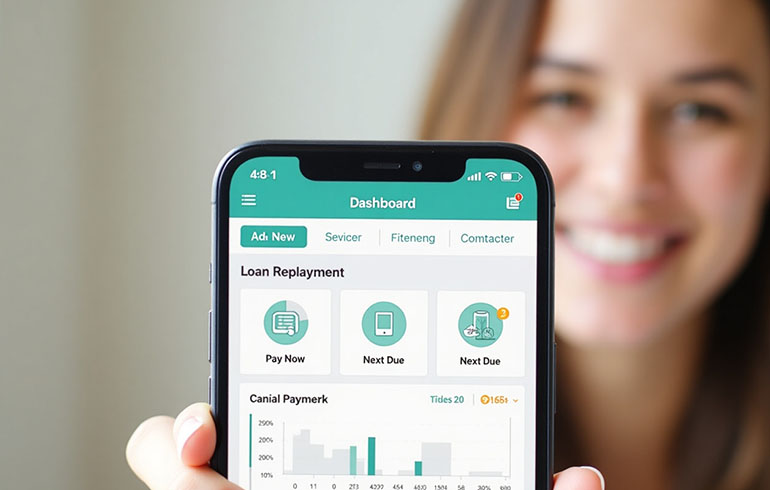

In a bid to streamline financial obligations, fintech companies have launched a suite of innovative digital tools designed to simplify loan repayment processes. These tools, now available across various mobile and web platforms, allow borrowers to automate payments, receive reminders, and track their outstanding balances in real time. This digital shift is expected to drastically reduce late fees and missed payments.

With the rise of these smart repayment solutions, users can now integrate their bank accounts and set up recurring debit instructions with ease. Advanced features like income-sensitive payment calculators, payment forecasting, and one-click loan consolidation are also being integrated. This ensures borrowers have a clear understanding of their financial obligations and repayment timelines.

Financial institutions have praised the new tools for their ability to improve repayment rates and reduce default risks. By offering borrowers more control and visibility, lenders report an increase in customer satisfaction and a decrease in loan delinquencies. Some platforms even gamify the process, offering rewards for early or consistent payments.

Security is also a top priority for these platforms. Most digital repayment tools are backed by encrypted technology, ensuring user data remains protected. Users can enable two-factor authentication and receive instant alerts for every transaction, adding a layer of trust and transparency to their loan management experience.

As more people embrace digital banking, experts predict that traditional manual repayment methods will become obsolete. Governments and financial regulators are encouraging this shift, citing increased efficiency and accessibility. Whether repaying student loans, microloans, or business financing, borrowers now have more convenience and confidence in managing their debt than ever before.