Digital Loan Apps See Massive Growth Across Europe

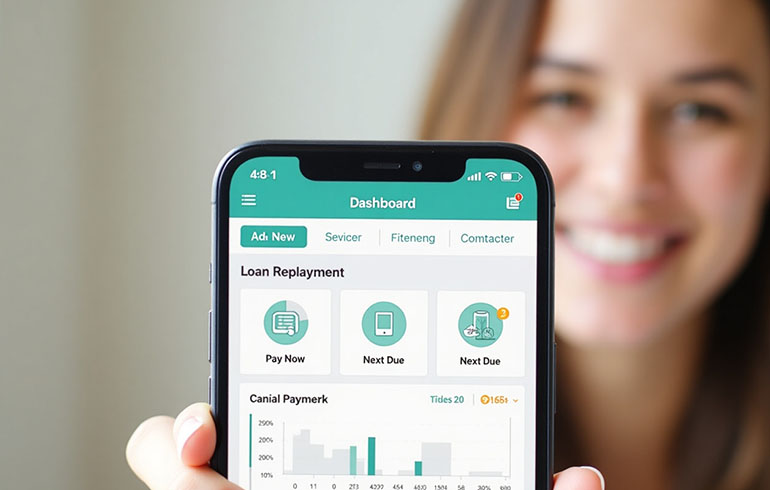

Digital lending platforms are experiencing unprecedented growth across Europe in 2025, transforming the traditional loan industry. With just a smartphone and a stable internet connection, users can now access credit in a matter of minutes. The shift is largely fueled by growing demand for faster, paperless borrowing processes and the increasing trust in fintech services across both urban and rural communities.

Countries like Germany, France, and Spain are leading the charge, with hundreds of thousands of users signing up monthly on digital loan platforms. Many of these apps offer flexible repayment plans, low interest rates, and instant disbursement, making them a preferred choice among millennials and small business owners. The user-friendly design and simplified onboarding processes are removing the intimidation often associated with bank loans.

Fintech firms are also adopting advanced security protocols and AI-powered credit scoring to ensure safe and accurate lending. These algorithms allow platforms to evaluate borrower risk using non-traditional metrics, including e-commerce history, mobile spending patterns, and even online behavior. As a result, individuals without a prior credit history are now finding access to loans easier than ever.

Regulatory bodies across Europe have started responding to this growth by introducing frameworks to monitor and license digital lending companies. The goal is to protect users from predatory lending practices while also encouraging innovation in the financial sector. Governments are also partnering with select platforms to promote access to credit for underserved groups like freelancers, immigrants, and students.

With user adoption showing no signs of slowing down, digital loan apps are quickly becoming a staple of Europe’s evolving financial ecosystem. Analysts predict that within the next two years, digital lending could outpace traditional banks in terms of the number of loans disbursed. For now, the momentum is clearly in favor of these nimble, tech-powered solutions that are reshaping how Europeans borrow money.